Making monthly pay work with an on-demand lifestyle can be difficult. That’s why we believe in flexible pay. Instant Pay is an in-app feature that allows Orka Workers to cash out on approved shifts before the monthly pay date. All Orka Workers can use this feature which allowed them to access up to 50% of wages from approved timesheets whenever they need it.

Here’s how you use Instant Pay.

Your payment options

There are two options for getting paid with Orka Works: Monthly or Instant Pay.

With monthly pay, your wages are transferred into your bank account on the same day every month.

With Instant Pay, you can get more flexibility and access 50% of your wages from approved shifts whenever you need them, for a fee.*)

Our Workers can choose the solution that works best for them.

*You will pay a flat fee of 4% on any amount withdrawn from Instant Pay. This will be automatically calculated and has to be approved by you at the time of withdrawal. The minimum withdrawal amount is £50.

Getting started

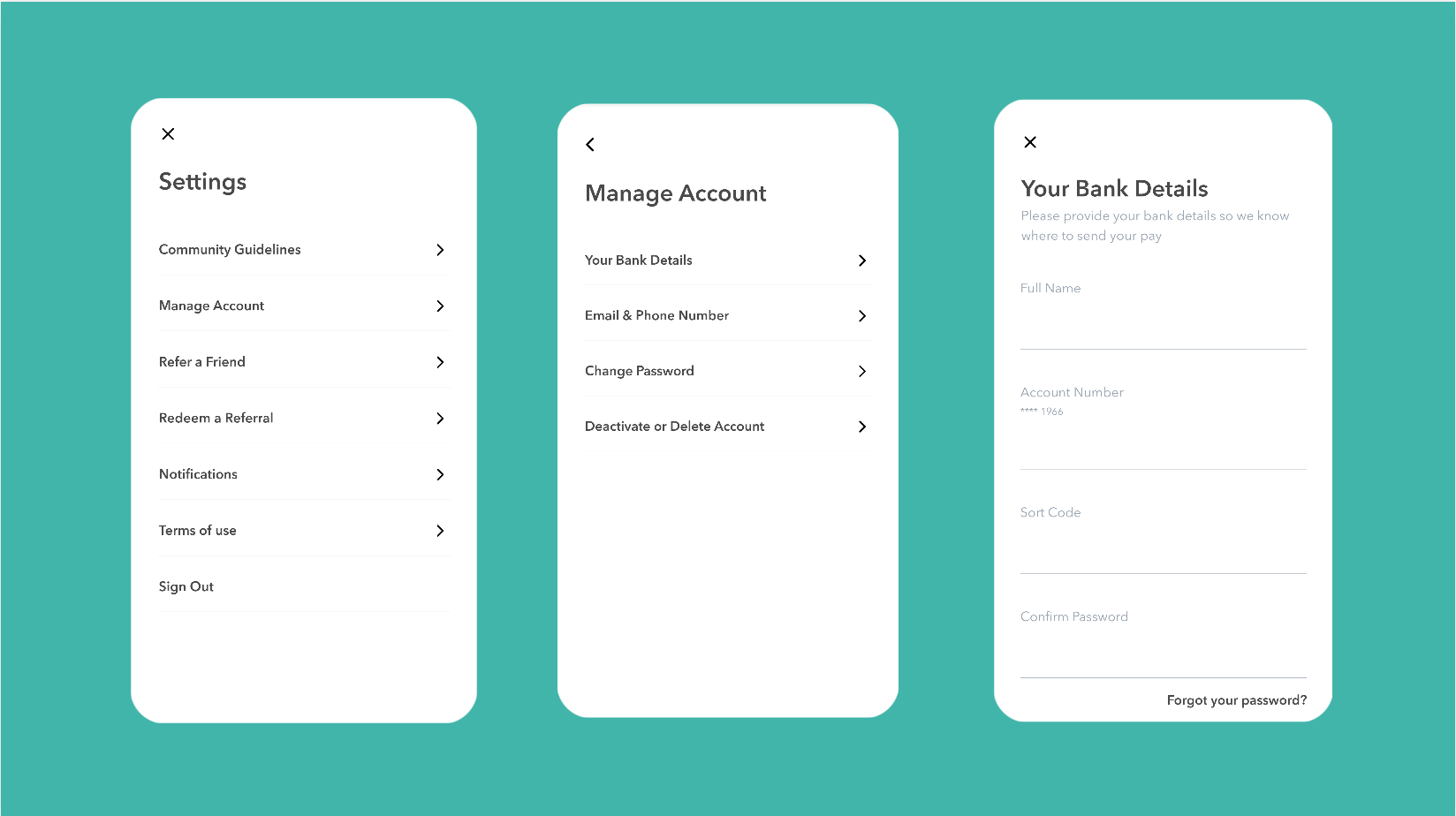

Before any payments can be made, make sure you have up-to-date and correct bank details registered in the app. To do this, navigate to the profile section of the app and click the cog in the right-hand corner.

After this, select Manage Account > Your Bank Details and update your account number and sort code.

Withdrawing from Instant Pay

Using Instant Pay is simple. When you’ve worked at least one shift on the app, and your timesheets for this have been approved, you can access Instant Pay.

Navigate to the Profile section of your app.

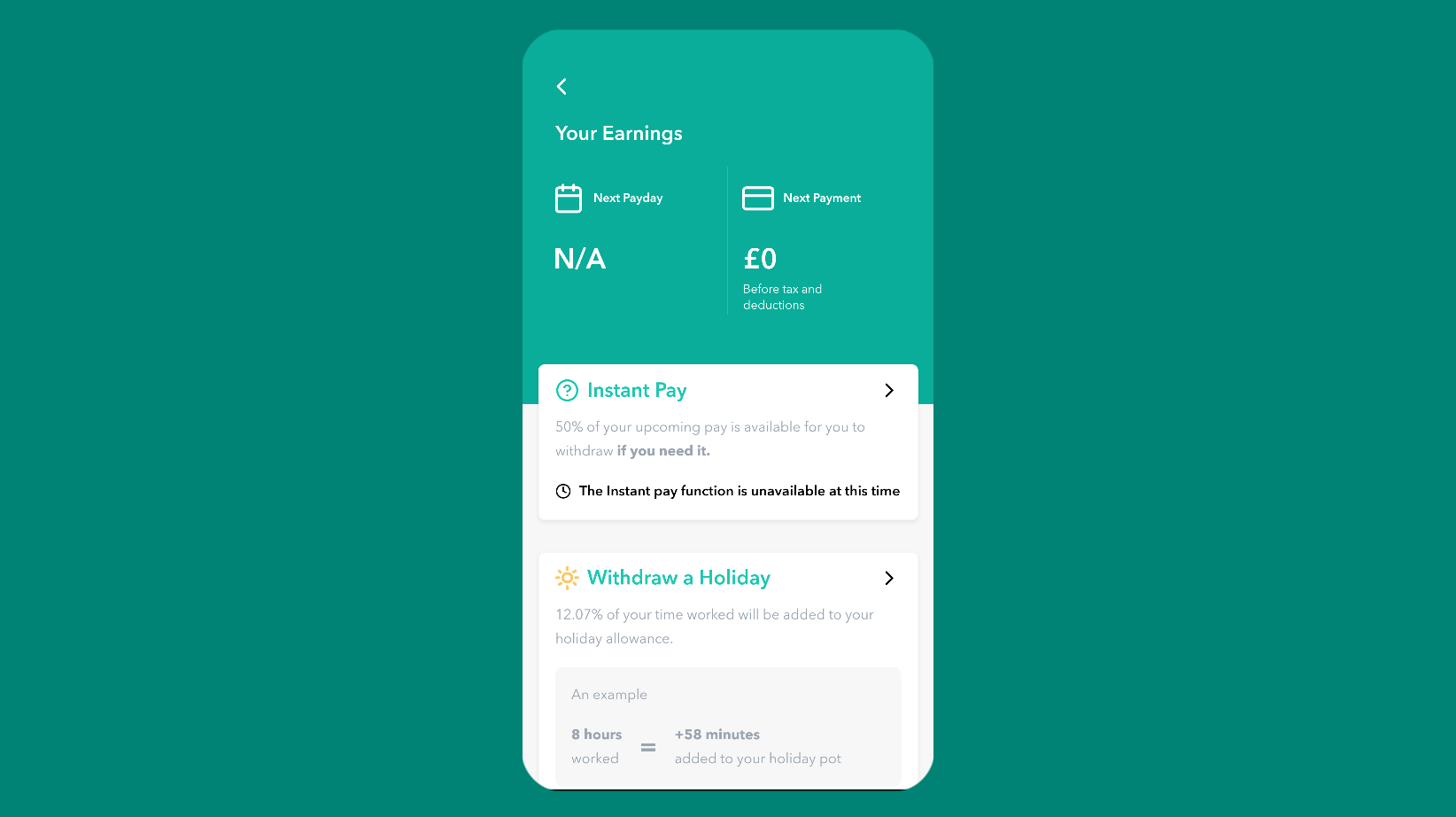

Then, click on the Your Pay tile.

From here, you’ll see an overview of your earnings. Click on the Instant Pay tile:

This will start the Instant Pay withdrawal process. Your next steps will be:

- Choose the amount you’d like to withdraw from your Instant Pay balance.

- Review the total amount, including the service charge.*

- Approve the transaction.

- Once you approve the transfer, the money should appear in your bank account within seconds.

Managing your money

Giving you access to flexible pay is meant to help you manage your money and to give you a better alternative to credit, overdrafts and loans. However, tools like Instant Pay should always be used responsibly and in moderation to help you stay on top of your finances.

We ask workers to avoid using Instant Pay for the following purposes:

- Covering large, non-essential purchases.

- To enable gambling or betting.

- Withdrawing large amounts without budgeting.

- To pay off other loans or unmanageable debts

Here’s more advice and resources on how to manage debt and money.